Trusted by 2,200+ industry leading financial institutions

Catch threats earlier, onboard faster, and boost auto-approval rates by up to 44%

Every risk check,checked

Know who you're working with

Instantly verify the identity, associated contacts, and legitimacy of 100% of U.S. businesses.

A single score representing all signals of business verification, designed for intelligent decisioning.

Automate industry (NAICS Code) lookup, and catch bad actors falsely claiming low risk NAICS codes.

Verify officers, owners, and signers for sanctions, legal, and military risk — all in one API.

Go deeper on financial standing

Search for and file liens against businesses from a single platform.

Identify lawsuits, bankruptcies, and other red flags tied to a business.

Gain visibility into online presence to reduce fraud and operational drag.

Baselayer’s proprietary business credit risk score, built from multi-source data.

Make your first line of fraud defence your strongest

Tap directly into Baselayer’s fraud intelligence network to detect emerging trends and prevent repeat fraud.

Get ahead of risk, and stay there

Continuously track sanctions, fraud, adverse events, and entity changes with configurable, real-time alerts.

Risk moves fast.

Move faster with Baselayer.

Built for confident approvals at scale

Baselayer connects fragmented data and applies AI to help you act early and with more confidence.

Reveal hidden identity risks.

Tap into a cross-platform network to detect emerging fraud trends before they spread.

Baselayer Identity NetworkConsolidate every data source.

Bring public, proprietary, and partner sources together to strengthen every check with real-time insights.

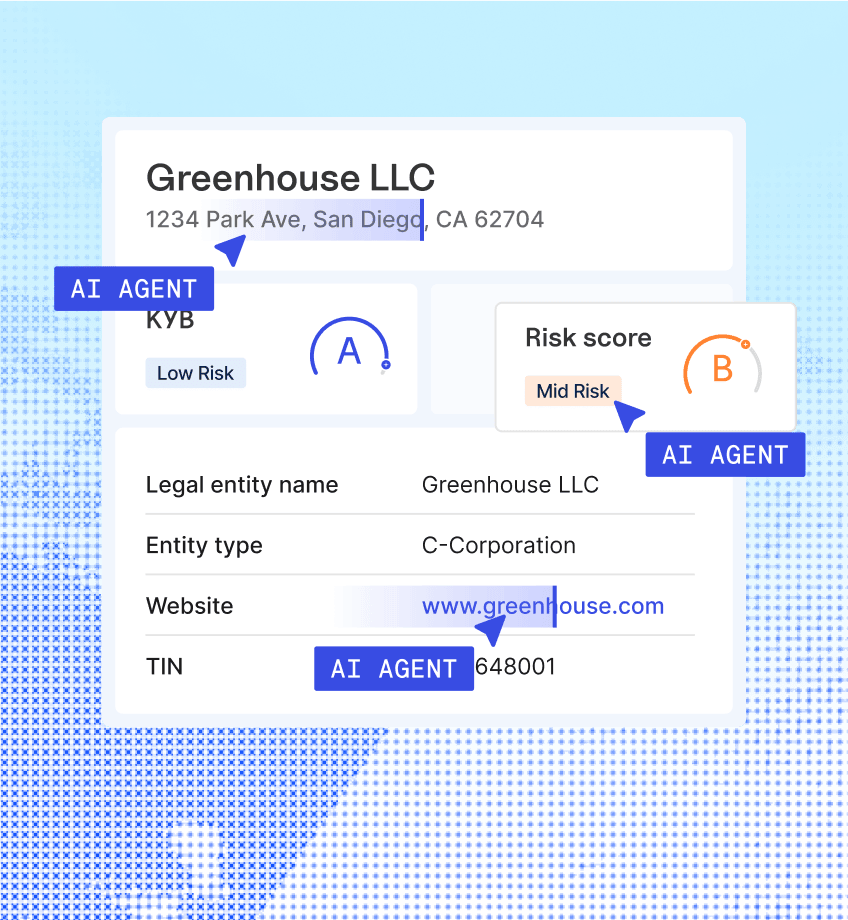

Our Data SourcesAutomate the busywork.

Let Baselayer's AI agents put monotonous work on autopilot with unparalleled accuracy and scalability.

Baselayer AI Agents