Risk Rating

Score SMB risk, no credit history required

Turn public records, behavioral patterns, and identity signals into actionable risk scores, even before financial underwriting begins.

Trusted by 2,200+ industry-leading financial institutions

Most SMBs lack meaningful credit data or have files that don’t tell the full story, leaving legacy scoring blind to early risk signals.

Score industry risk at onboarding

Baselayer infers industry classification based on web presence, business activity, and operational profile, even when the applicant leaves the field blank.

Catch alternate names and stacking risk

Detect multiple name variants and inquiry permutations tied to the same EIN or business name, a common signal of synthetic or bust-out fraud.

Monitor inquiry velocity across the network

Track EIN-level search patterns across Baselayer’s identity graph to identify excessive or risky application activity.

Verify operational longevity

Leverage real-time Secretary of State filings and domestic registration data to confirm entity age and status – without the manual work.

Read more about liens

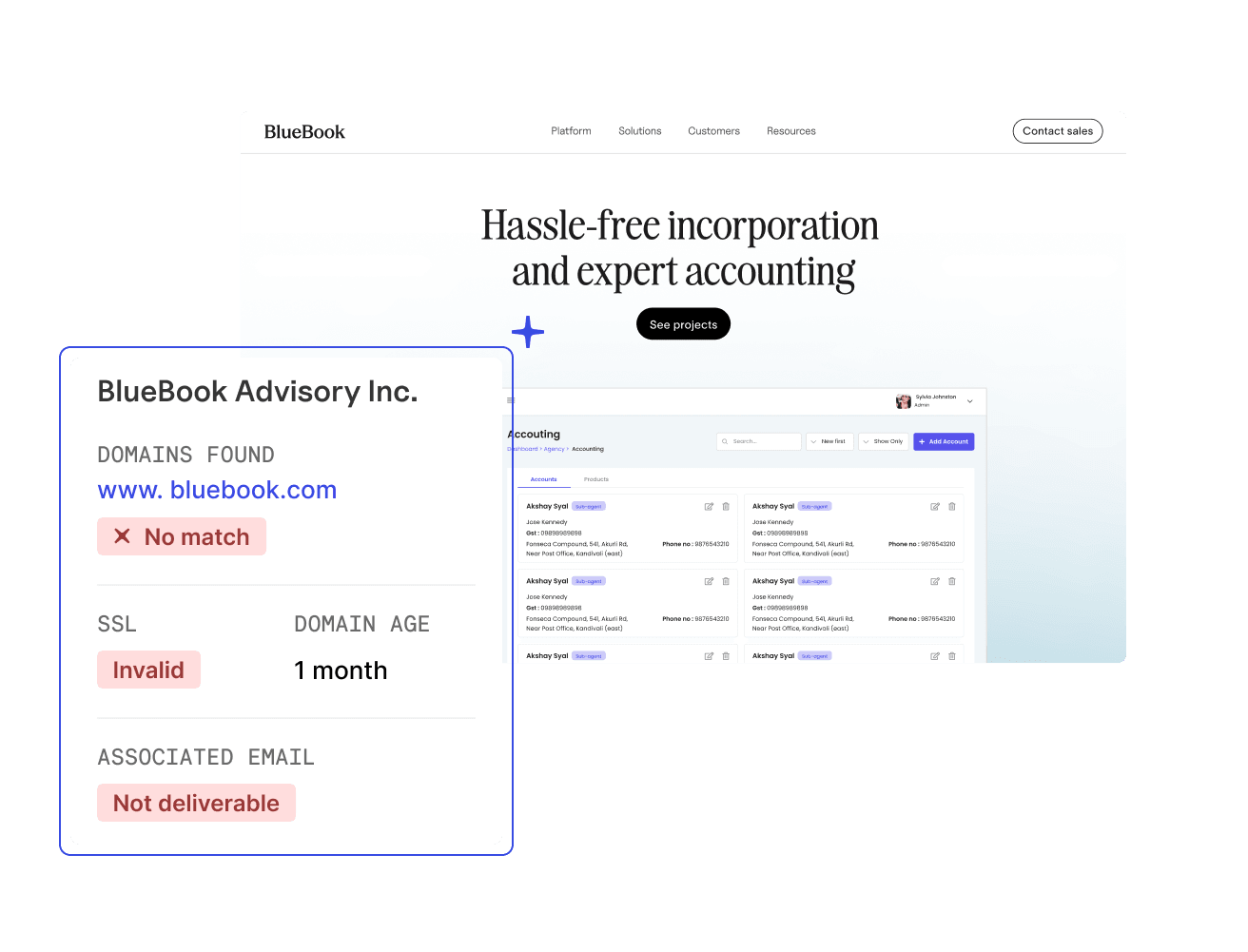

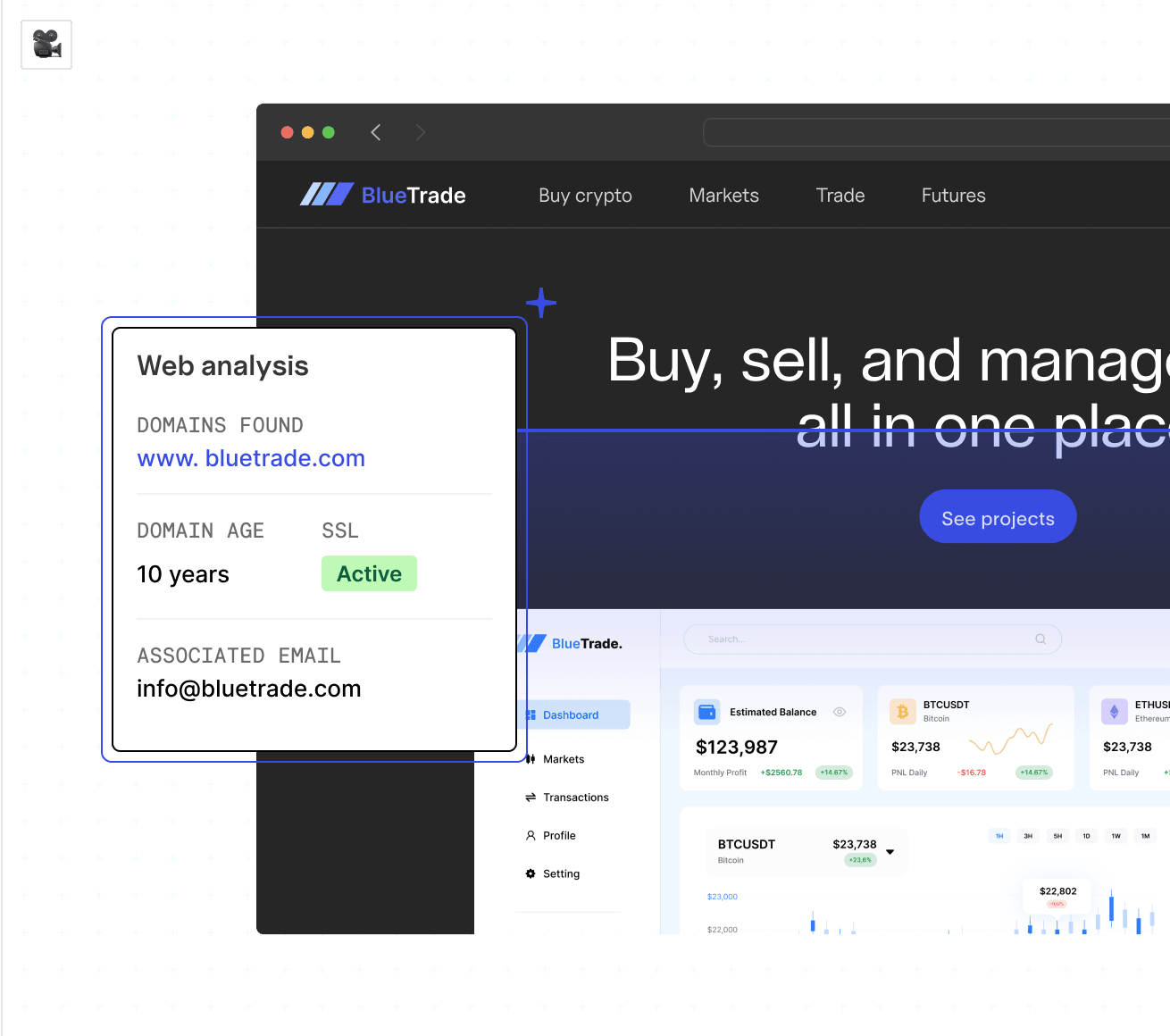

Validate digital footprint and legitimacy

Evaluate domain age, website status, deliverability of contact emails, and linked business profiles to assess digital credibility.

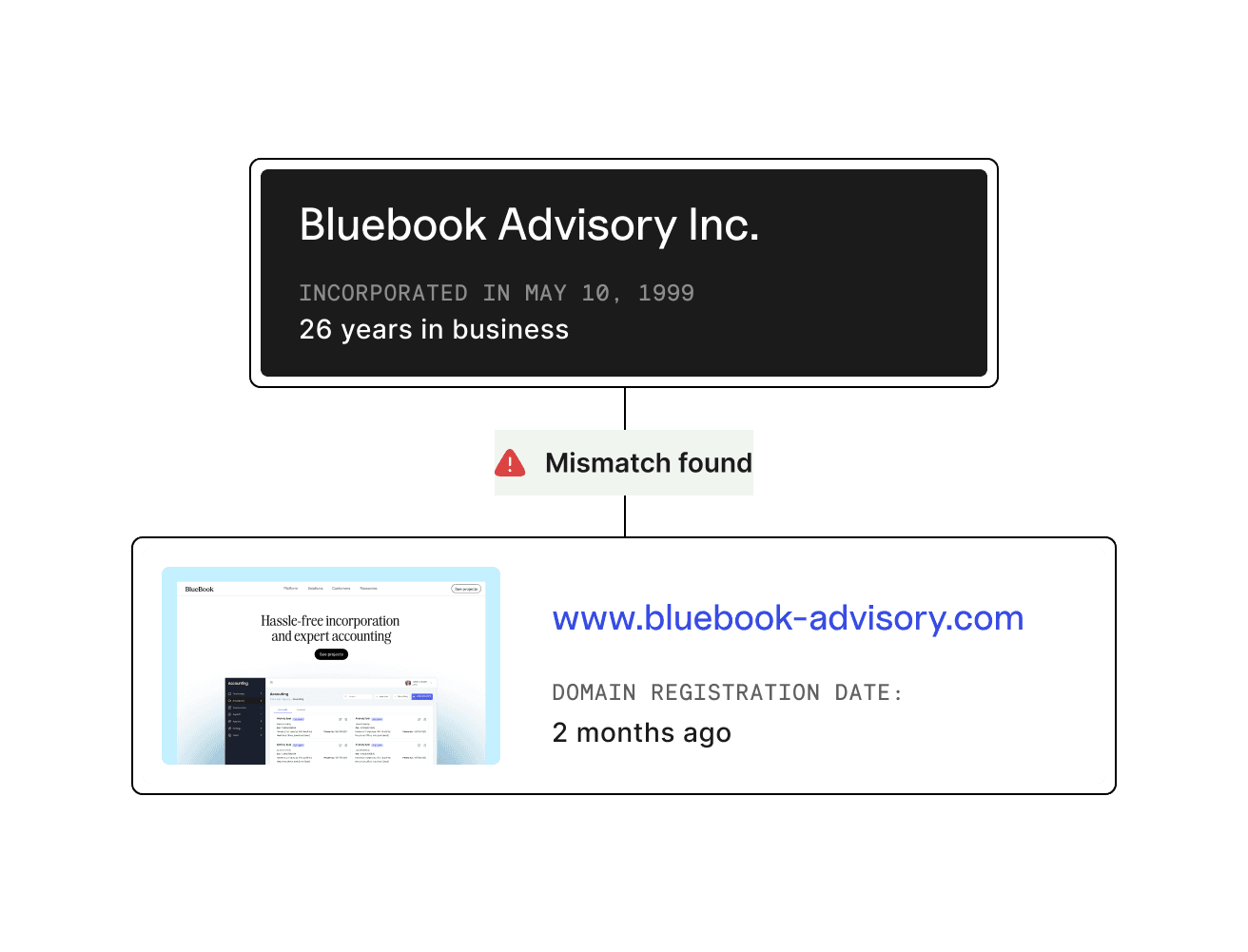

Detect synthetic staging and anomalies

Compare business registration date with domain creation to surface staged entities, synthetic behavior, or credibility mismatches.

Turn signals into smarter decisions

Product Managers

Credit & Underwriting Teams

Risk & Fraud Teams

Compliance Teams

Built for confident approvals

Baselayer connects fragmented data and applies AI to help you act early, and with more confidence.

Explore more ways to mitigate risk

Layer in litigation, digital footprint, and behavioral scoring to build a fuller risk picture.

Liens (Searching & Filing)

Spot hidden claims before you approve.

Lawsuits & Bankruptcies

See legal risk before you approve.

Website Analysis

Validate digital legitimacy instantly

Have questions? Find answers.

It’s a real-time business risk score that helps you assess SMB creditworthiness, even when there’s not much financial history to go on. We use signals like operational activity, inquiry patterns, industry profile, and web presence to give you a fast, data-rich and actionable read on risk.

It plugs right into your onboarding and decisioning engine to give you a clear risk signal upfront. That means faster approvals, fewer manual reviews, and more confident automation, without the guesswork.

Most business credit scores lag behind or miss early-stage and thin-file businesses entirely. Baselayer’s Risk Rating updates in real time with industry-leading data freshness and coverage, flagging legal and operational risk even when credit data is limited or unavailable.

Many SMBs don’t show up on traditional credit models. Risk Rating helps you evaluate them anyway using public records, web activity, and shared fraud signals, so you can say yes more often without increasing risk.

Absolutely. Each score comes with a clear breakdown of the factors that influenced it, so your team always knows what’s driving the result.

We pull from public records, business registrations, digital footprint data (like domains and websites), and fraud signals from over 2,200 financial institutions to give you a complete picture of business risk.