Raising the Bar: Baselayer’s New Look

Business onboarding used to feel like flying blind.

Weak signals. False positives. And the real risks? They slipped through. Buried in paperwork. Every decision dragged, costing time, money, and trust.

We built Baselayer to change that.

A new look for an even bigger mission.

You may have spotted hints of something new this week, and maybe even played The Case of the Phantom Loan.

Today we’re unveiling the next phase of Baselayer.

More than a logo refresh. This is the next step toward becoming the de facto signal of legitimacy and risk for businesses: the blue check for the real economy.

Our updated brand is designed to feel the same way we want your onboarding process to feel: clear, accurate, and fast.

But if you’ve worked with us, you know we’re not about words or looks. This new brand is simply a marker of how far we’ve come, and how fast we’re moving.

The base layer for business

In the early days, our focus was microscopically clear: helping lenders cut hours in manual reviews and the underwriting process to get capital to the right small businesses faster.

Today, we’re expanding that impact, building the complete foundation for business identity, credit and fraud.

Baselayer now powers customer identification programs (CIPs) and onboarding decisions for 2,200+ financial institutions, fintechs, payments companies, and e-commerce platforms.

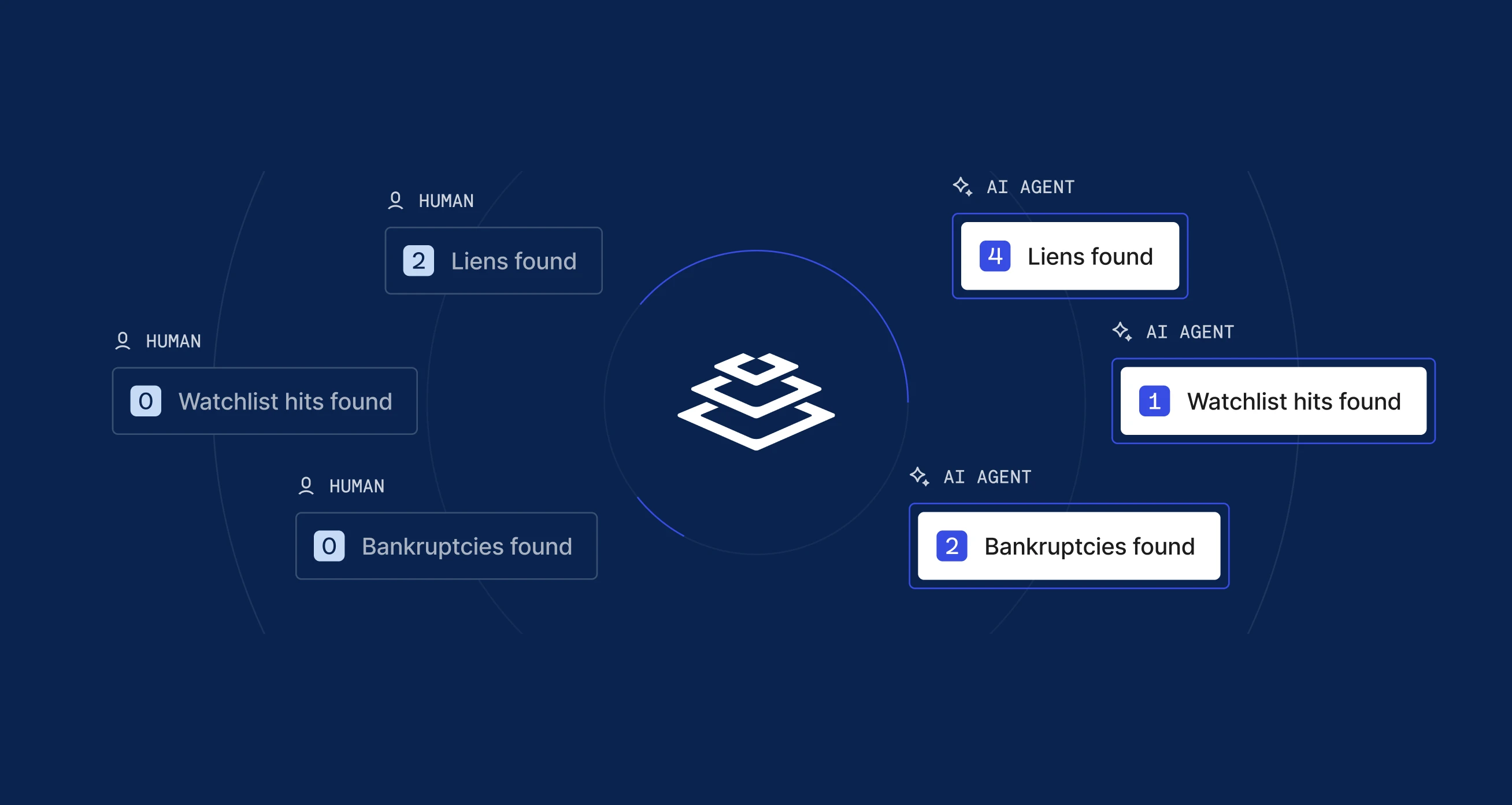

Top identity, risk, and decisioning platforms now tap into the millions of signals flowing through:

- The Baselayer Business Identity Network, which gives instant visibility into application history and bust-out patterns

- Baselayer AI Agents, that automate repetitive tasks and conduct checks with unparalleled speed and analyst-level accuracy

- Plus, the nation’s largest Fraud Consortium, which prevented over $100M in fraud losses over the last year

Approving 100% of legitimate customers, without increasing fraud losses or manual reviews, is possible today with Baselayer.

What’s next

This year alone we’ve shipped 200+ improvements, launched five new products, and started working with hundreds of fantastic partners.

Baselayer now helps millions of legitimate businesses access funding each month while giving financial institutions the trusted intelligence needed to move fast and stay secure.

As fraud patterns evolve, we’re focused on building stronger signals, smarter automation, and future-ready tools that keep our customers one step ahead.

Risk moves fast, move faster with Baselayer.