The Problem

Real-Time Lending Decisions Demand Speed and Precision

Slope is a B2B payments and embedded credit platform that provides businesses with instant access to working capital through real-time underwriting decisions.* Every decision to extend credit to a business must be made quickly, often within seconds, and inaccuracies can lead to fraud, exposure, and churn.

Traditional business verification methods were either too slow or not accurate enough for the complexity of the decisions Slope needed to make. When underwriting transactions instantly, latency hurts performance, but sacrificing accuracy has even greater long-term consequences.

Slope faced the classic tradeoff: fast but shallow checks, or comprehensive but slow ones. Neither was sufficient for the level of precision Slope required.

The solution

Striking a Balance with Comprehensive, Instant Verification

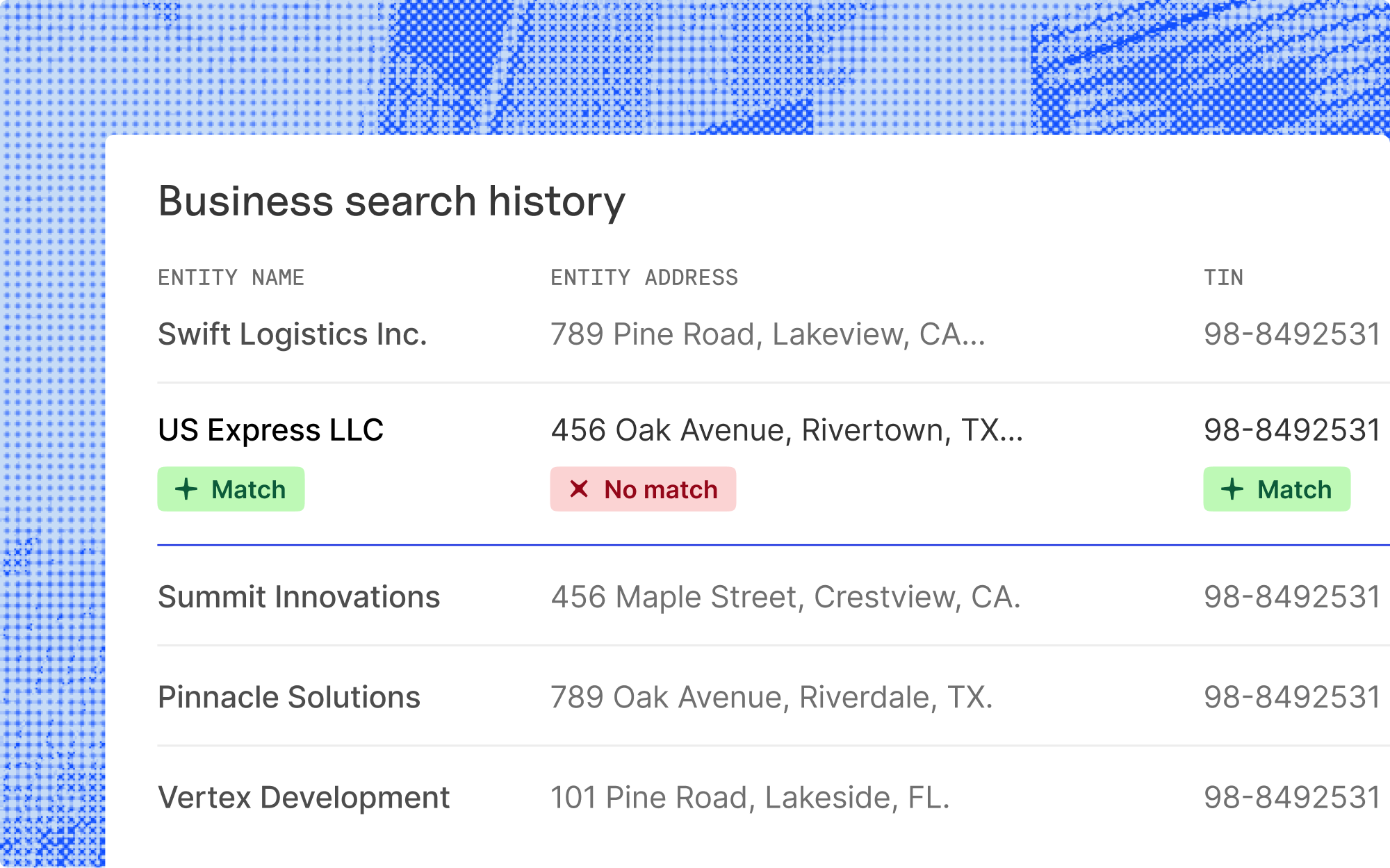

Slope partnered with Baselayer to improve the balance between latency and accuracy in business identity verification. Unlike legacy systems that slow underwriting with manual workflows and outdated data, Baselayer provides near-instant access to verified business information, including Secretary of State filings and public records, through a modern API.

“Baselayer’s approach to business verification achieves a strong balance between latency and accuracy. It aligns well with products like ours that require complex decisions in real-time.”

Beyond speed and accuracy, integration was also critical. Baselayer stood out not only for its data quality but also for how easily it fit into Slope’s existing risk infrastructure. With pre-processed KYB data and consistent performance, Slope could integrate it directly into its decisioning engine and scale operations smoothly.

The results

Confident, Instant Credit Decisions Without Compromise

With Baselayer supporting its KYB workflows, Slope now makes instant, high-confidence credit decisions while maintaining strong risk controls. Unlike providers that fetch records only upon request, Baselayer pre-processes data in advance, ensuring consistent performance even as volumes increase.

“Baselayer’s approach to pre-processing KYB data provides consistent low latency and high coverage,” says Russell Gu, Credit Risk at Slope. “Other providers fetch KYB data on-demand, which can slow down onboarding. Baselayer helps us avoid this problem.”

Today, Slope processes thousands of applications daily with both speed and accuracy. Baselayer helps filter out fraud sooner, onboard legitimate customers quickly, and maintain strong decision quality, all without increasing operational overhead or risk exposure. What previously was a significant tradeoff is now an operational advantage Slope consistently leverages.