The Problem

Manual KYB Reviews Were Slowing Down a Digital-First Bank

As a client-first, full service digital bank, Grasshopper built its services around scale and automation. But when it came to Know Your Business (KYB), those goals were harder to fully realize. Too often, the business banking onboarding flow halted for manual review due to fragmented data and unclear or incomplete business profiles.

Even with robust front-end and back-end partners, Grasshopper’s team had to investigate up to 15% of new applications manually, looking up company websites, searching Secretary of State records, and sifting through filings just to verify basic legitimacy.

KYB has traditionally not been a very automated process. It’s time-consuming and it forces analysts to do work that should be handled by data.

The challenge went beyond onboarding. As Grasshopper further expanded its small business lending operations, the team needed a unified way to pull deep risk signals (bankruptcies, liens, judgments) without relying on slow, manual research.

The Solution

Real-Time Risk Intelligence for a Fully Digital Lending Experience

Grasshopper turned to Baselayer to bring the speed, structure, and intelligence it needed into KYB and credit decisioning.

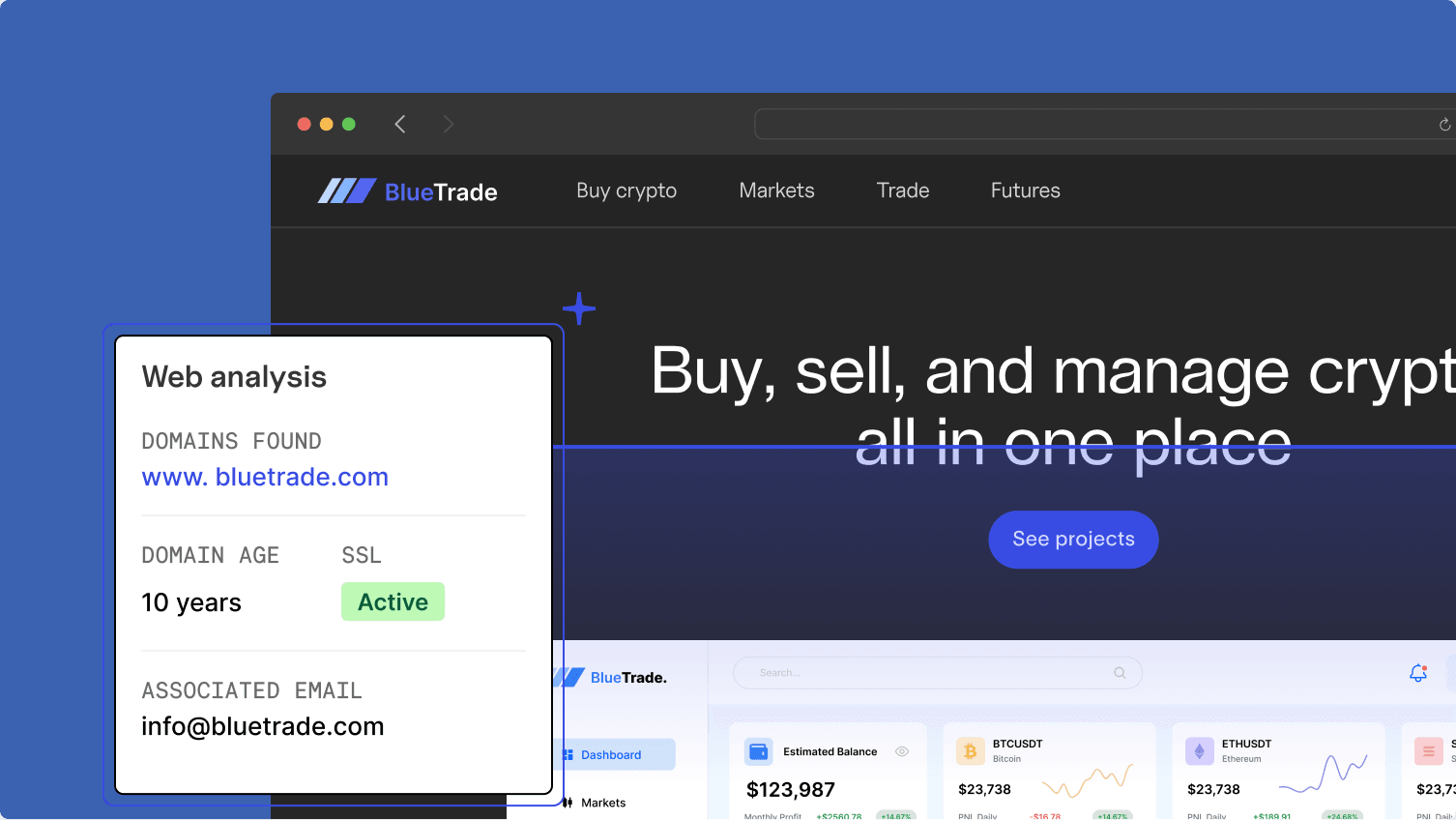

Today, Baselayer integrates directly into Grasshopper’s existing onboarding flow, surfacing verified KYB data, risk, lien checks, and automated industry prediction, all without requiring applicants to supply a website or additional details.

“The ability to generate risk scores and industry classifications even when we don’t receive a URL has been phenomenal,” Teddy says. “It lets us shrink the application, improve conversion, and still retain the insights we need.”

Baselayer’s website intelligence was especially important, autonomously discovering and parsing a business’s online footprint while bringing speed, consistency, and broader data coverage to a process that traditionally requires manual effort. Just as importantly, it surfaces patterns and metadata at a scale and depth that’s difficult to achieve through traditional methods, especially across thousands of applications.

The unified Baselayer console helps Grasshopper’s fraud and credit teams investigate and resolve cases faster. Analysts can view risk signals, filing histories, KYB Ratings, and Risk Ratings all in one place, eliminating tab-hopping and disconnected tools. That clarity lets the team spend less time chasing data and more time focusing on the nuanced judgment calls that truly require a human in the loop.

“It’s easy to use. The letter-grade risk ratings seem small, but when you’re reviewing thousands of applications, even small efficiencies add up,” says Teddy.

The Result

Faster Reviews, Fewer Exceptions, and a Stronger Digital Lending Stack

With Baselayer integrated, Grasshopper’s analysts now resolve flagged applications 14% faster, thanks to structured data delivery and a unified risk view. At the same time, the bank has seen a 5% increase in KYB auto-approvals, reducing manual workload and accelerating onboarding for low-risk applicants.

“For a lean bank like us, fast answers make a real difference,” Teddy says. “Baselayer feels less like a vendor and more like a partner.”

As Grasshopper expands its SMB lending products, including SBA and term loans, it continues to rely on Baselayer to streamline due diligence, automate filings, and power decisions at scale. What was once manual is now automatic. What once slowed onboarding now fuels a frictionless, bank-grade digital lending experience.