Portfolio monitoring

Stay ahead of risk beyond onboarding

Continuously track sanctions, fraud, adverse events, and entity changes with configurable, real-time alerts that support CDD Rule 4 compliance.

Trusted by developers and industry leaders at 2,200+ financial institutions

Without continuous monitoring, risk signals slip through, compliance gaps widen, and your team is left reacting too late.

Monitor real-world risk in real time

Instantly track sanctions, adverse events, fraud signals, and status changes via configurable, real-time alerts.

Screen for sanctions automatically

Continuously check entities against updated global sanctions and watchlists without lifting a finger.

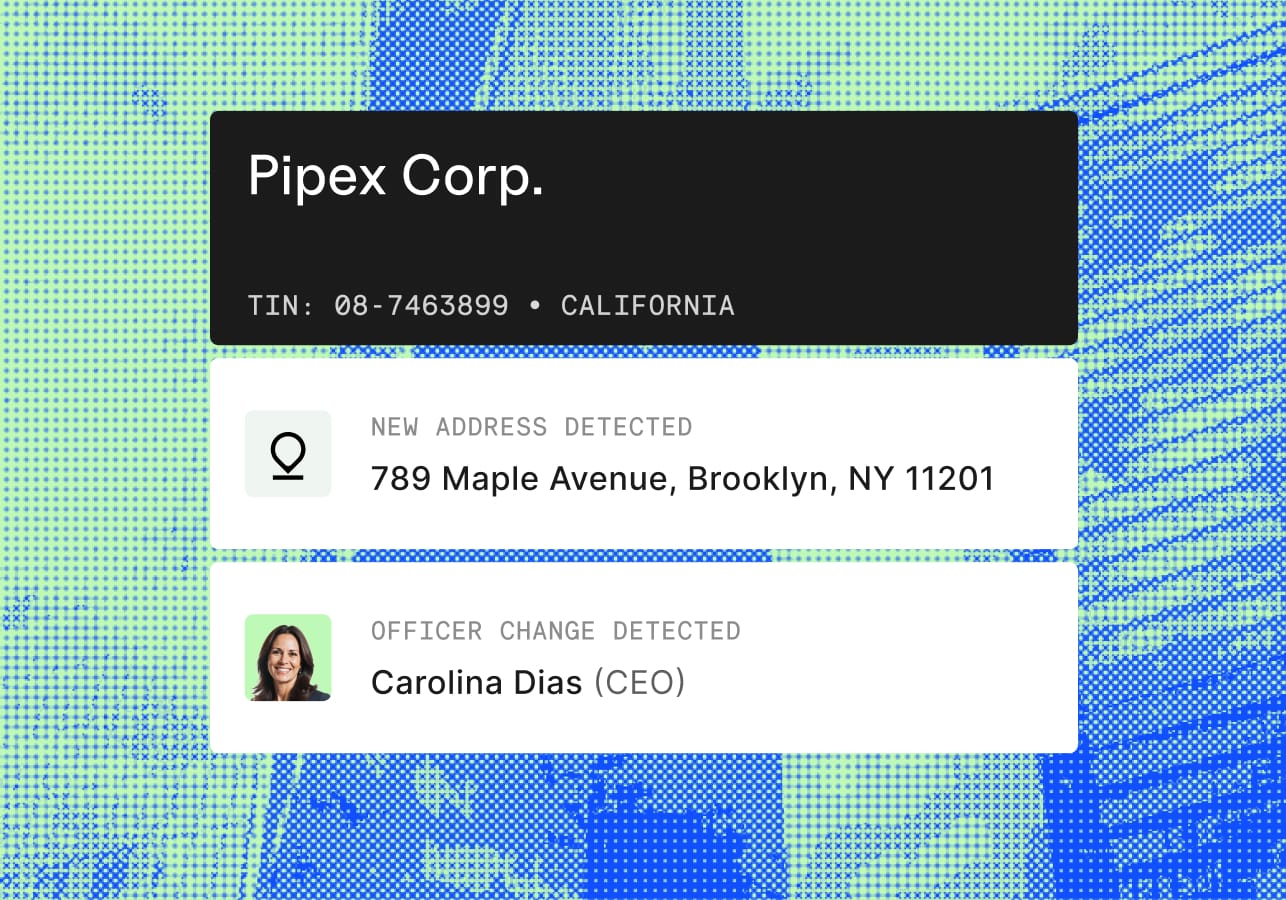

Detect business changes instantly

AI-powered detection of legal, operational, or status changes as they occur, helping surface risk before exposure.

"[Baselayer] is a key part of how we’re helping credit providers reduce risk, proactively monitor their portfolio, and streamline lien filing without sacrificing confidence."

Tune alerts to your thresholds

Control what triggers a flag and what doesn’t. Cut false positives and act on what matters.

Connect risk across Baselayer

Get smarter signals by integrating ongoing monitoring with the full Baselayer platform and identity graph.

Get smarter signals by integrating ongoing monitoring with the full Baselayer platform and identity graph.

Turn signals into AI-powered decisions

Product Managers

Credit & Underwriting Teams

Risk & Fraud Teams

Compliance Teams

A Risk Co.Pilot engineered to deliver fast, reliable decisions at scale

Accelerate your workflows through the most advanced enterprise-grade API and web application for uncovering KYB, credit, and fraud signals.

Have questions? Find answers.

Baselayer Business Verification gives you instant access to verify virtually every one of the 120M U.S. businesses, including 30M+ actively operating. You just need two fields, name and address, and you’ll get a holistic business report in seconds..

Baselayer helps you identify 60% more legitimate businesses and convert 50% more good applicants. Unlike legacy vendors that rely on stale batch lists, we pull directly from Secretary of State and IRS records with industry-leading refresh—so you never miss real businesses due to outdated data.

You don’t need perfect data to get perfect results. Baselayer’s intelligent matching automatically resolves common issues like typos, swapped addresses, or abbreviated names, so you can onboard qualified businesses without manual cleanup or asking applicants to resubmit information.

Baselayer returns results in under 5 seconds and plugs directly into your onboarding flow, no extra steps or added friction. Our verification improves auto-approval rates by 44% compared to legacy vendors, helping you sign up trusted businesses faster without slowing things down.

Baselayer gives you early warnings based on inquiry patterns from 2,200+ financial institutions—so you can catch stacking, velocity spikes, and synthetic fraud before it hits your portfolio.