Industry Prediction

Real-time classification, real-world accuracy

Automatically predict industry codes and assess category-specific risk with AI-powered precision.

Trusted by developers and industry leaders at 2,200+ financial institutions

Business names are often ambiguous, and website fields go unfilled, leading to misclassification, regulatory exposure, best guesses and poor decisioning.

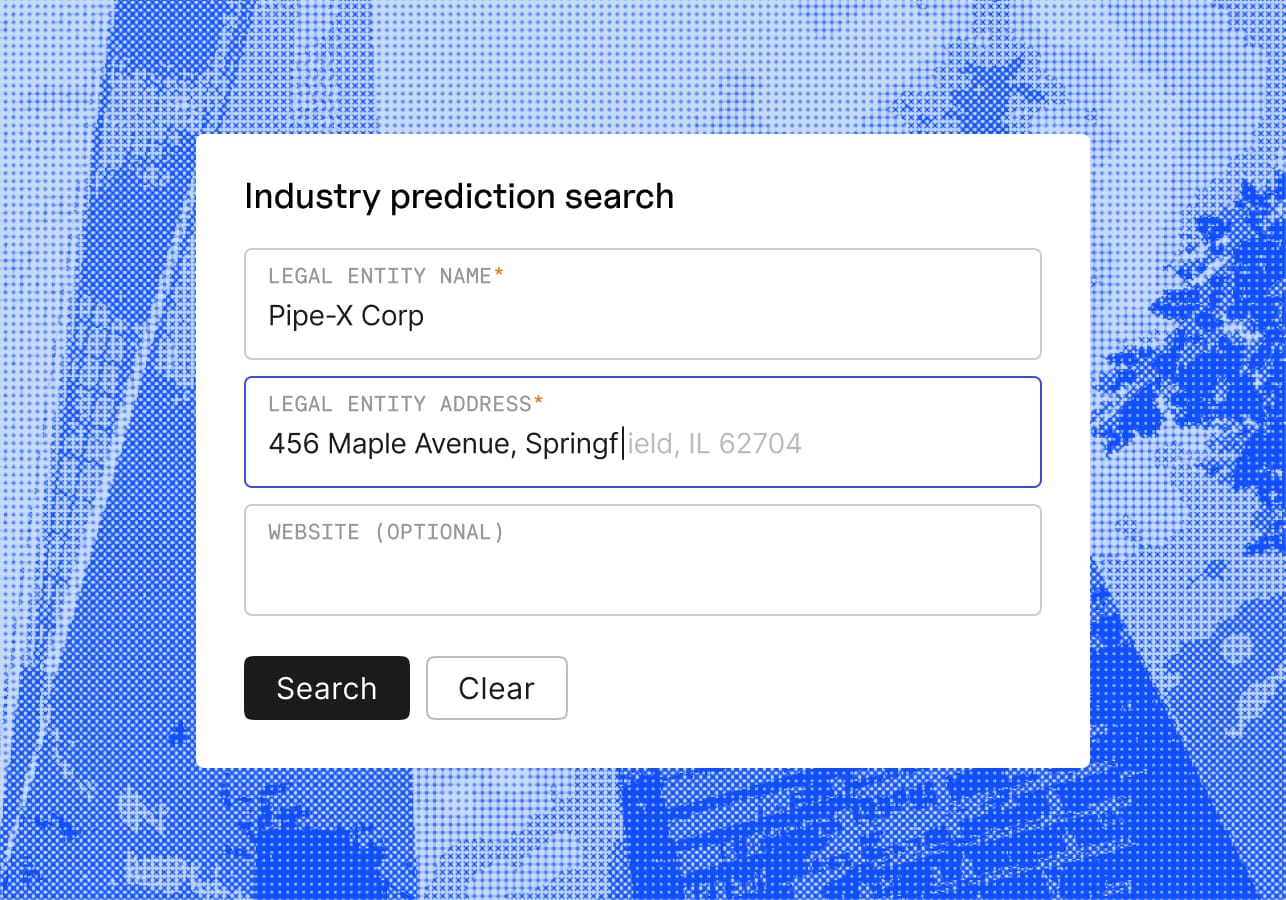

Infer industry from limited inputs

Accelerate your workflow using AI insights you can trust, producing accurate industry codes from a business name and address, even when no website is available.

Enrich without relying on the applicant

Baselayer’s Risk Co.Pilot automatically enrich input data, resulting in an 86% improvement in website identification.

Structured insight, built into every AI-driven prediction

Baselayer returns standardized codes, descriptions, and risk tiers to inform critical onboarding decisions.

"I’m a big fan of the keyword‑based industry prediction.... I can craft my own verticals, group businesses by bespoke categories, and feed that nuance straight into our models."

Maximize business operations insights with AI

Go beyond static NAICS codes. AI-native agents analyze keyword clusters and business context to predict industry, enabling approval criteria that reflect real-world business behavior.

Predict industry, even without a website

Roughly 30% of SMBs lack a web presence. Baselayer’s Risk Co.Pilot uncovers the business name, address, and filings, ensuring no segment is left behind.

Embed directly into onboarding flows

Predictions are delivered instantly via our API, designed to support KYB, pricing, and decisioning rules at scale.

Predictions are delivered instantly via our API, designed to support KYB, pricing, and decisioning rules at scale.

Turn signals into AI-powered decisions

Product Managers

Credit & Underwriting Teams

Risk & Fraud Teams

Compliance Teams

A Risk Co.Pilot engineered to deliver fast, reliable decisions at scale

Accelerate your workflows through the most advanced enterprise-grade API and web application for uncovering KYB, credit, and fraud signals.

Extend predictions into decisions

Apply industry predictions across verification, KYB, consumer risk, and reputation signals.

Business Verification

Get instant identity clarity.

KYB Rating

Summarize risk in seconds.

Consumer Solutions

Uncover the people behind the business.

Social Media & Reviews

Go deeper into businesses.

Have questions? Find answers.

Baselayer’s Industry Code Prediction is a real-time tool that tells you what a business actually does based on automated website discovery and web presence review. You get accurate NAICS codes, industry labels, and risk tiers without relying on self-reported information that can be misleading.

Industry misclassification leads to inaccurate pricing, fraud losses, and regulatory issues that are expensive to fix. Baselayer takes the guesswork out by automatically analyzing multiple data sources to give you accurate NAICS, MCC and SIC codes from the start, and flag cases where applicants misrepresent their industry.

That’s common and completely fine. We use name, address, filings, maps, and reviews to predict industry accurately even when no website exists, so you still get reliable classification data.

You’ll get structured NAICS, MCC, and SIC codes, plain-English industry descriptions, keyword clusters, and industry risk tiers, all delivered in real time via API and ready for use in your decision-making process.

Yes, we flag cases where the predicted industry doesn’t match what the applicant claims. This helps you catch fraudsters trying to appear low-risk by misrepresenting their actual business activities during the application process.

Baselayer uses keyword clustering to give you richer context from a business’s website, filling in missing details and flagging mismatches. It helps you confidently classify businesses, even when names or codes are vague or misleading.