Identity Network

Where no risk gets missed

Baselayer’s Identity Network connects anonymized activity across financial institutions to detect risk sooner and surface signals that would otherwise stay hidden.

Trusted by developers and industry leaders at 2,200+ financial institutions

Helping risk teams proactively combat fraud and credit stacking

Tap into an AI-powered network that connects patterns across millions of U.S. businesses to surface fraud rings, identity anomalies, and application velocity signals before they become losses.

Act faster, with conviction

Accelerate onboarding with confidence

Quickly greenlight low-risk businesses using corroborated identity signals across the network and prevent good businesses from going bad.

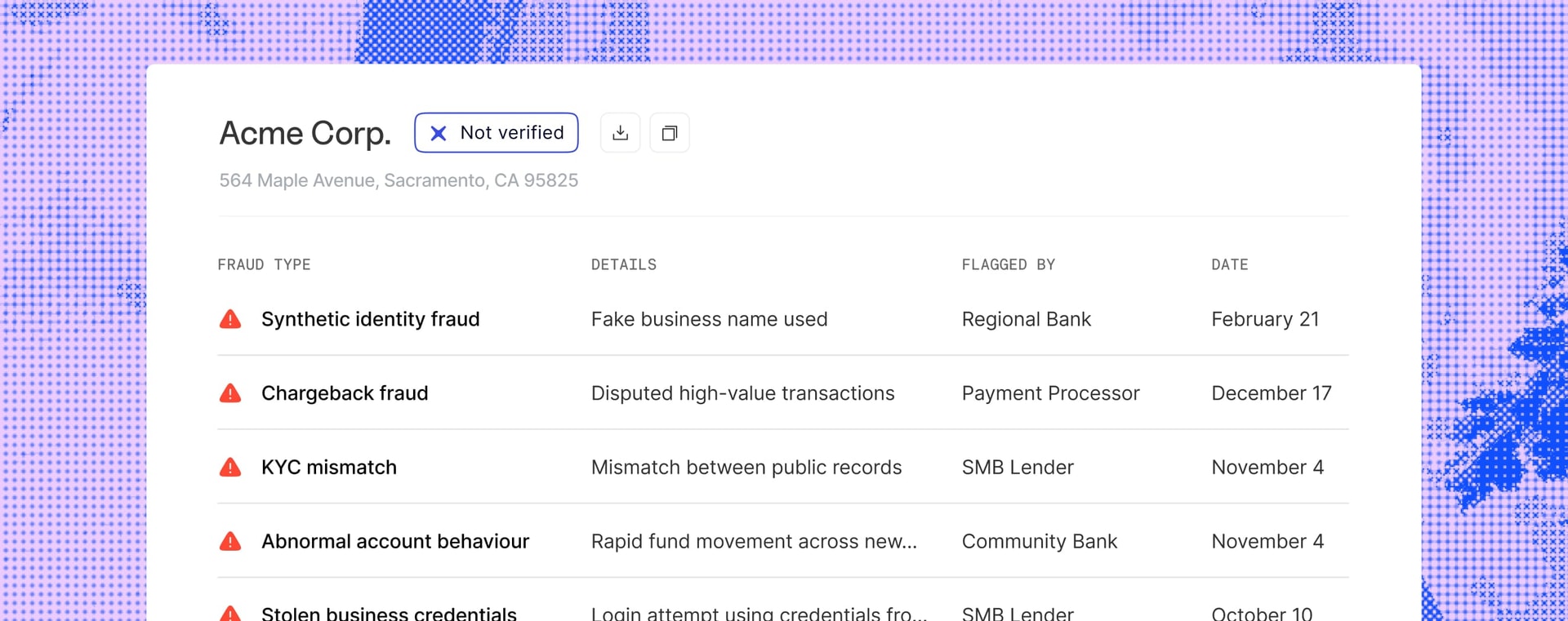

Spot identity theft before it spreads

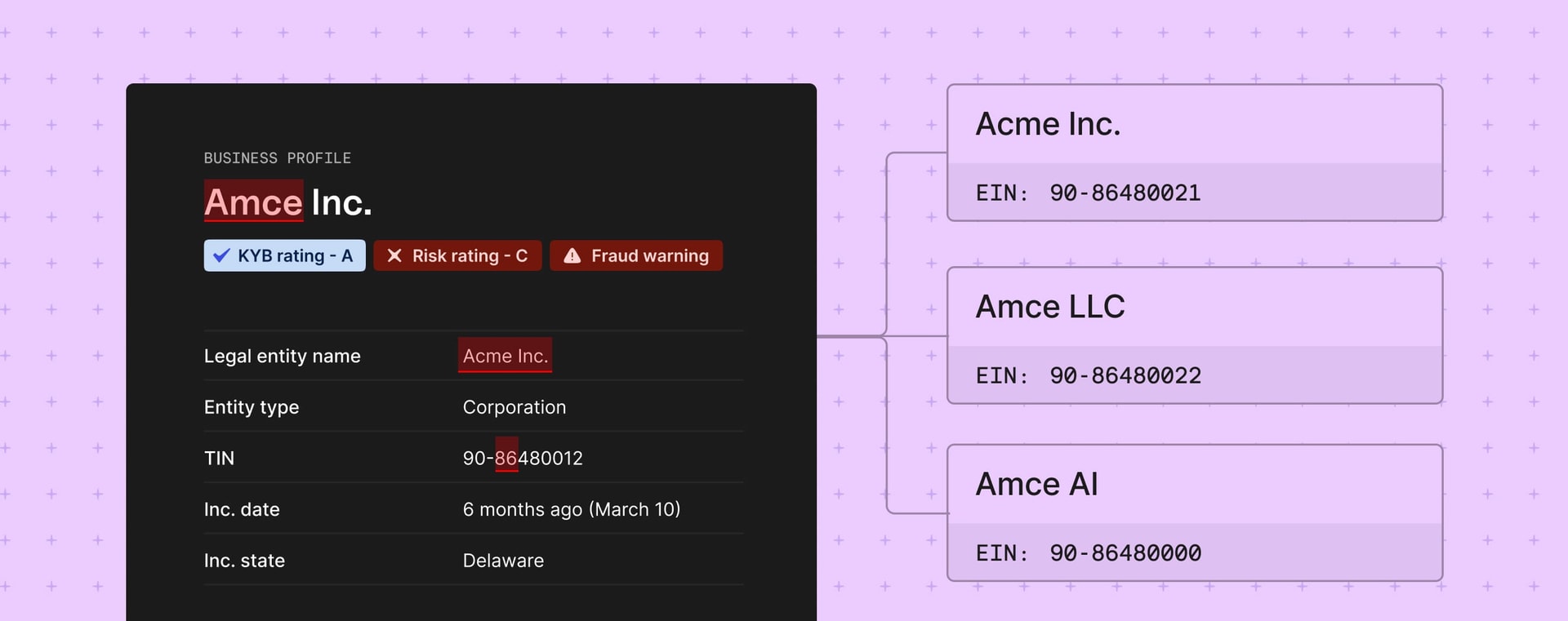

Catch subtle variations in EINs, names, and addresses that signal synthetic identity fraud before it enters your funnel.

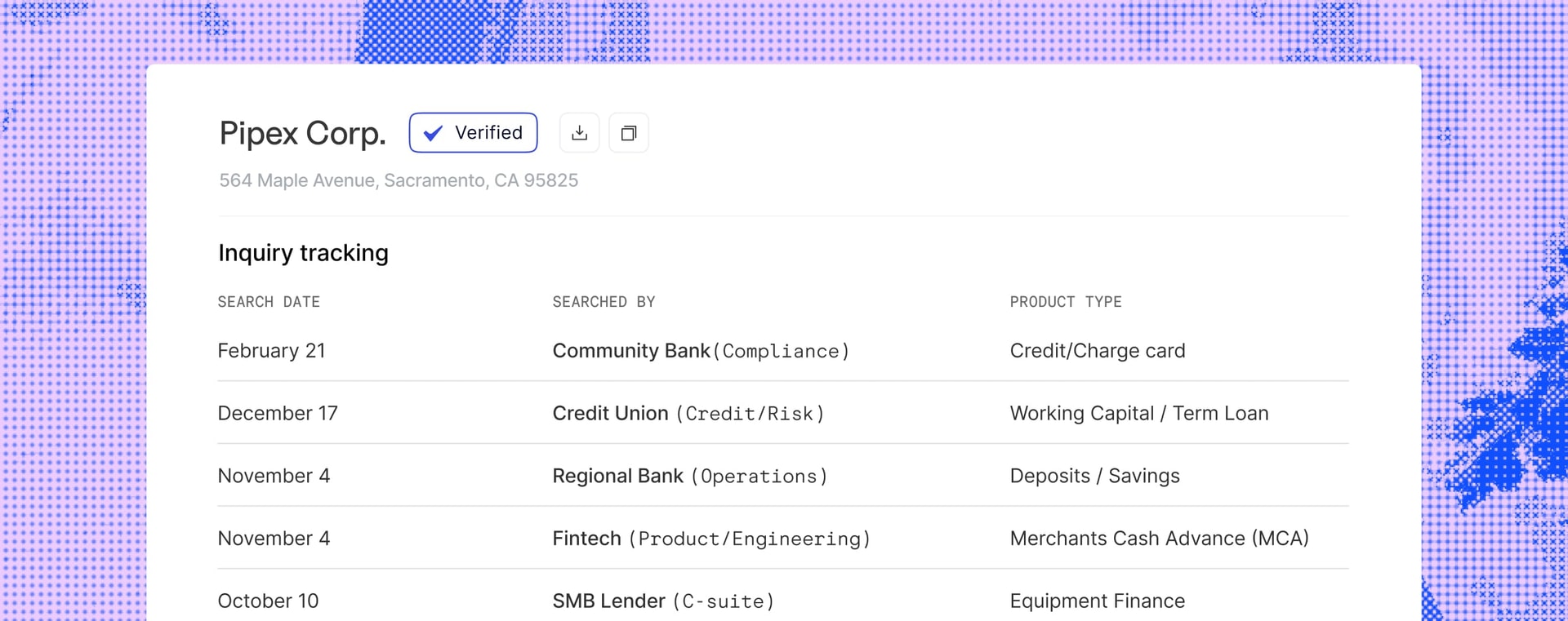

Stop credit stacking at application

See inquiry patterns across the network and flag high-risk behavior the moment it starts, not after it’s too late.

See what 20% of financial institutions already do

Tap into a shared layer of intelligence that helps over 2,200 institutions detect emerging risk before it spreads.

Baselayer lets us focus on the customers we actually want to serve, without simply increasing the requirements on everyone

Evan DreyerHead of Risk & Finance @ TOLA

[Baselayer] is a key part of how we’re helping credit providers reduce risk, proactively monitor their portfolio, and streamline lien filing without sacrificing confidence.

Colton PondCMO Head of Partnerships @ LoanPro

Apply network intelligence across the risk stack

Spot identity inconsistencies at scale

Correlate EINs, addresses, and entity names across applications to catch subtle variations and prevent misleading or duplicate onboarding attempts.

Know who you’re underwriting (and who else is)

Get visibility into how often a business is applying elsewhere with inquiry signals from across the network. Flag potential credit stacking before it happens.

Detect coordinated fraud attempts before they reach you

Tap into the largest business-reported fraud list to block entities, and stay ahead of new patterns with real-time ML signals across Baselayer’s ecosystem.

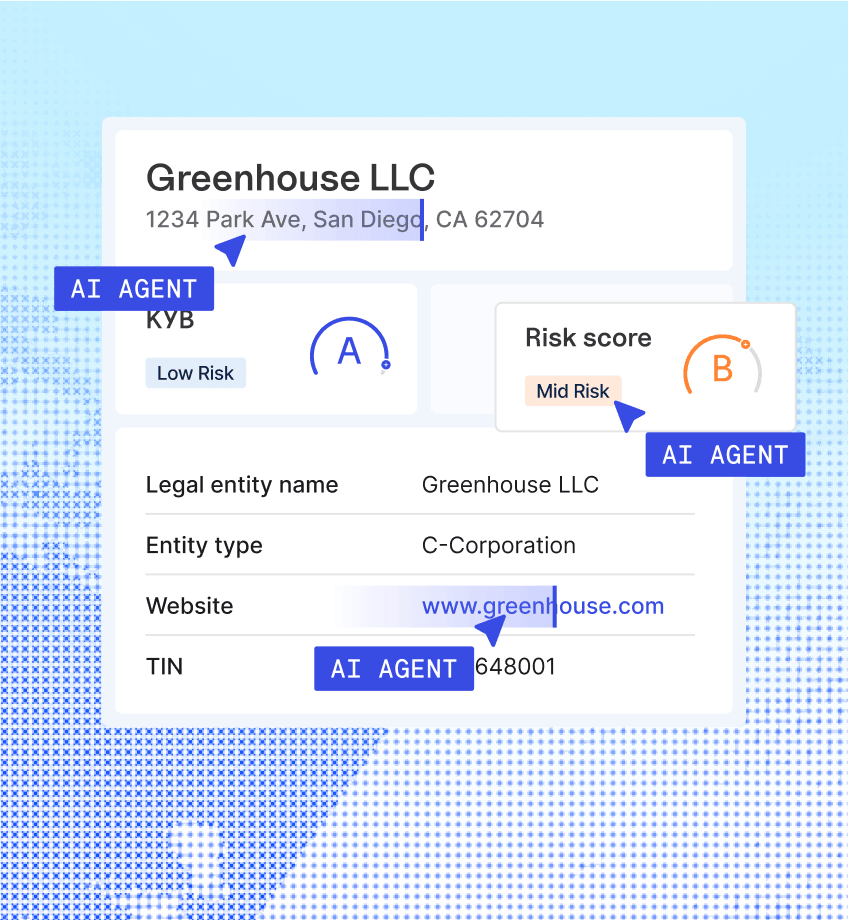

A Risk Co.Pilot engineered to deliver fast, reliable decisions at scale

Accelerate your workflows through the most advanced enterprise-grade API and web application for uncovering KYB, credit, and fraud signals.

Consolidate every data source.

Combine public, proprietary and partner data sources together into Baselayer's superintelligent platform for predictive real-time insights.

Our Data sourcesStop fraud before it spreads.

Leverage AI and verified fraud intelligence from top financial institutions to make your first line of fraud defense your strongest.

Fraud ConsortiumUnlock superintelligence.

Baselayer’s Risk Co.Pilot puts labor-intensive risk checks on autopilot, delivering instant, explainable decisions that reduce cost and minimize human error.

Risk Co.Pilot

Have questions? Find answers.

The Baselayer Identity Network is a real-time network that tracks how business identities are used across financial institutions. By linking business application activity across platforms, you get a behavioral layer for business identity that helps you detect stacking, velocity, and synthetic risk that traditional KYB can’t see.

KYB and credit checks validate who a business is, but Baselayer adds context around how that identity is behaving, including application frequency, across which institutions, and whether the pattern suggests risk. You get visibility into gaps that standard verification tools leave wide open.

By monitoring cross-platform application activity, the Baselayer Identity Network detects behavior patterns like stacking, bust-outs, and synthetic blends before credit data changes or fraud losses hit. You can spot coordinated fraud attempts while they’re still in the application stage.

Participation is anonymized and built around business signals without sharing PII. You contribute activity data in a privacy-preserving format and gain access to real-time intelligence from across the network without compromising customer privacy.

No, this isn’t about repayment history. Baselayer shows you how a business is being used right now across the financial ecosystem. It flags risky behaviors like application stacking or velocity spikes that traditional credit scores miss.

For credit score alternatives designed for SMBs see Baselayer Risk Rating.