Turn fragmented data into instant answers, serving businesses faster without raising risk.

Trusted by 2,200+ industry-leading financial institutions

Safer decisions at scale.

Automate identity, credit, and fraud checks to save hours per application, and free up teams for higher-value work.

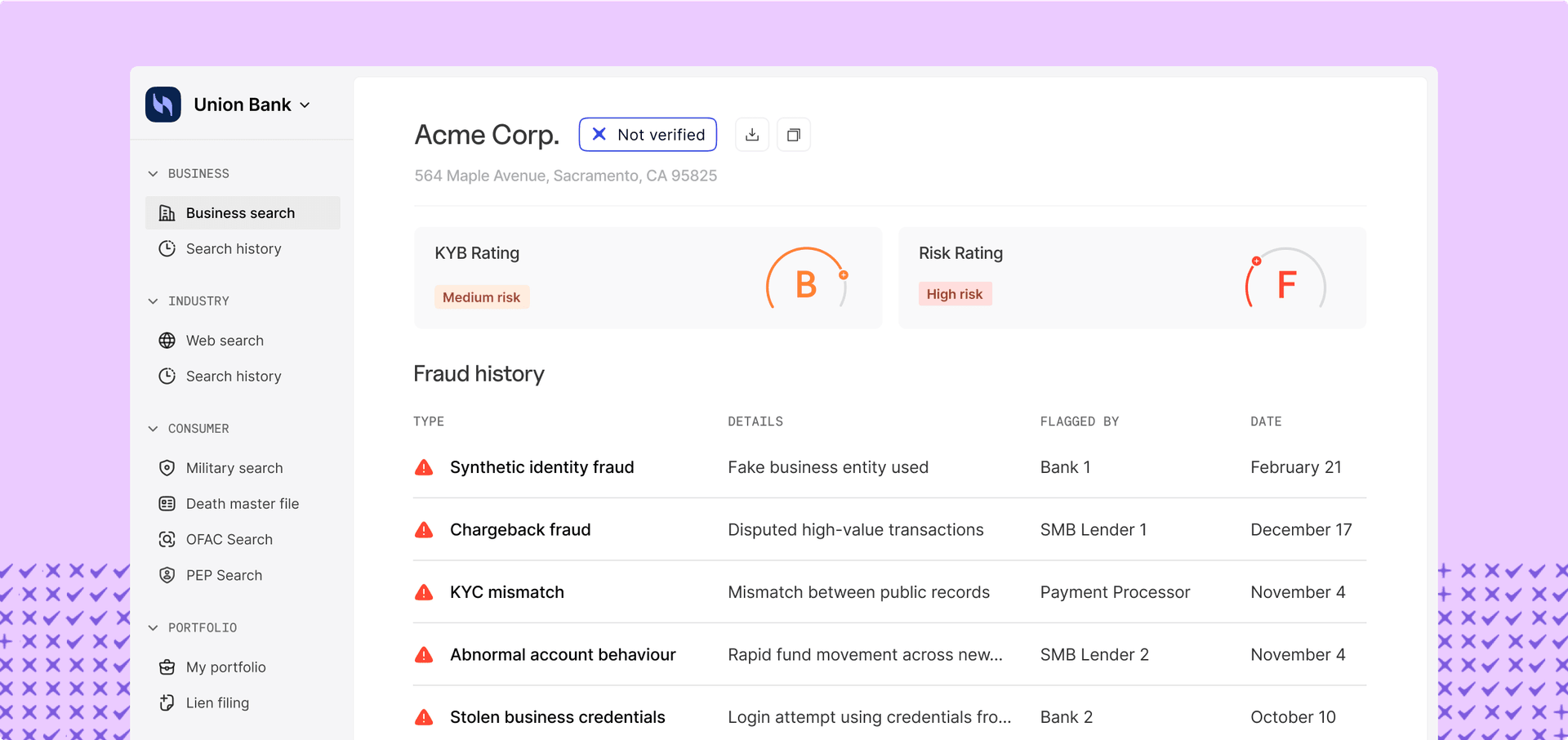

Block repeat offenders with consortium-powered alerts trusted by 2,000+ peer institutions.

Deliver audit-ready trails backed by government-verified data and transparent decision logic.

Catch emerging threats with always-on signals that track behavioral shifts, digital footprint anomalies, and past misconduct.

The interface is clean, the matching is accurate, and most importantly, it gives us confidence. It’s become a core part of how we de-risk our lending process.

Sarvesh BavejaRisk & Data Science @ Fundbox

Where Baselayer fits in your day-to-day.

Instant Business Verification

Real-time KYB Scoring

Credit Risk Insights

Fraud Consortium Intelligence

Digital Footprint Analysis

Every risk check,checked

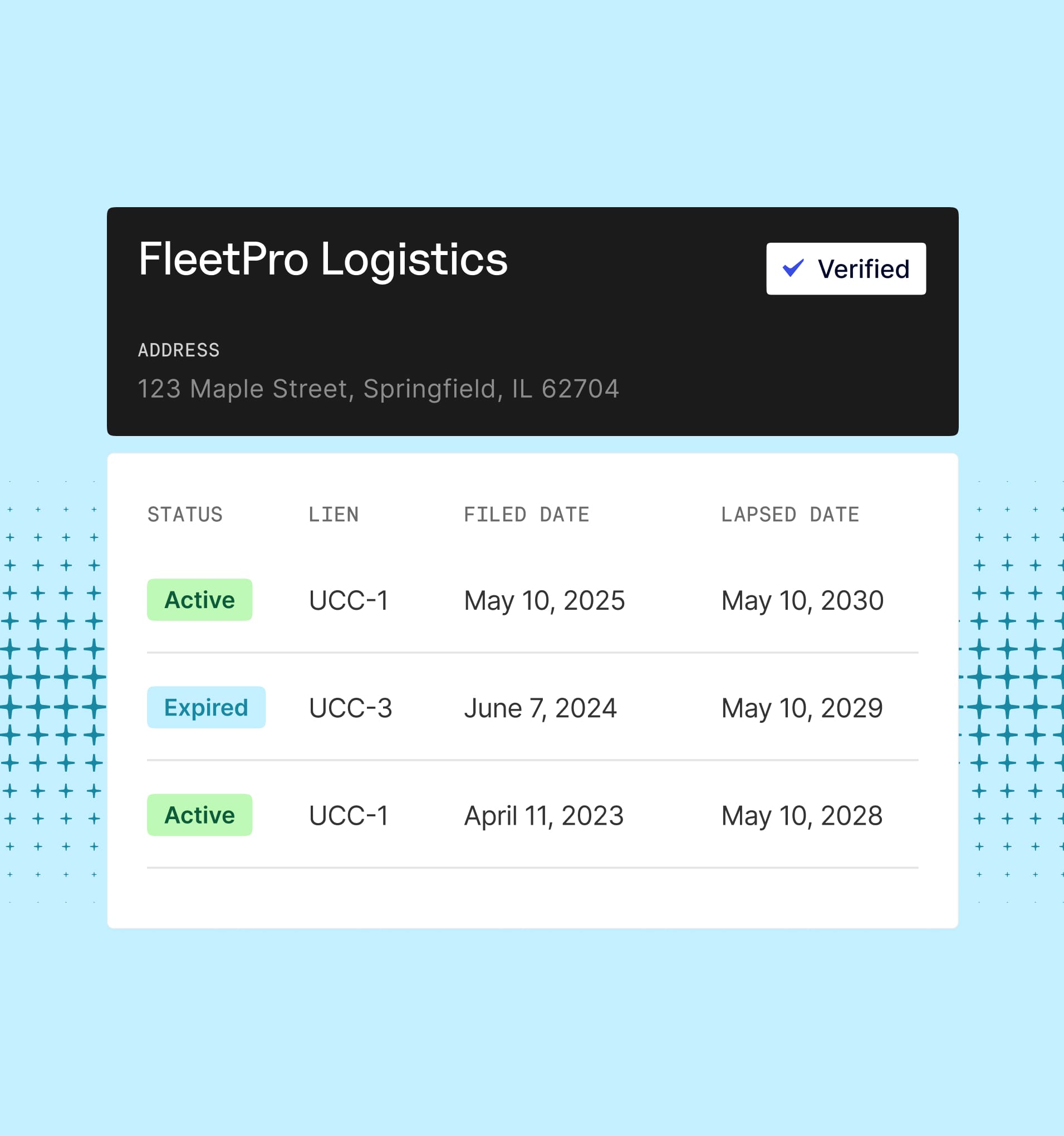

Know who you're working with

Instantly verify the identity, associated contacts, and legitimacy of 100% of U.S. businesses.

A single score representing all signals of business verification, designed for intelligent decisioning.

Automate industry (NAICS Code) lookup, and catch bad actors falsely claiming low risk NAICS codes.

Verify officers, owners, and signers for sanctions, legal, and military risk — all in one API.

Go deeper on financial standing

Search for and file liens against businesses from a single platform.

Identify lawsuits, bankruptcies, and other red flags tied to a business.

Gain visibility into online presence to reduce fraud and operational drag.

Baselayer’s proprietary business credit risk score, built from multi-source data.

Get ahead of fraud before it happens

Tap directly into a fraud intelligence network to detect emerging trends and prevent repeat fraud.