Consumer Solutions

Uncover the people behind

the business

Verify officers, owners, and signers for sanctions, legal, and compliance risk on demand.

Trusted by developers and industry leaders at 2,200+ financial institutions

KYB checks stop at the business, even though compliance failures and fraud risk often stem from who’s behind the application.

Instantly verify military status

Confirm borrower eligibility under the Military Lending Act and Servicemembers Civil Relief Act and automatically apply lending protections.

Catch compliance red flags early with AI

Screen individuals against OFAC, PEP, and global watchlists with intelligent screening and real-time data.

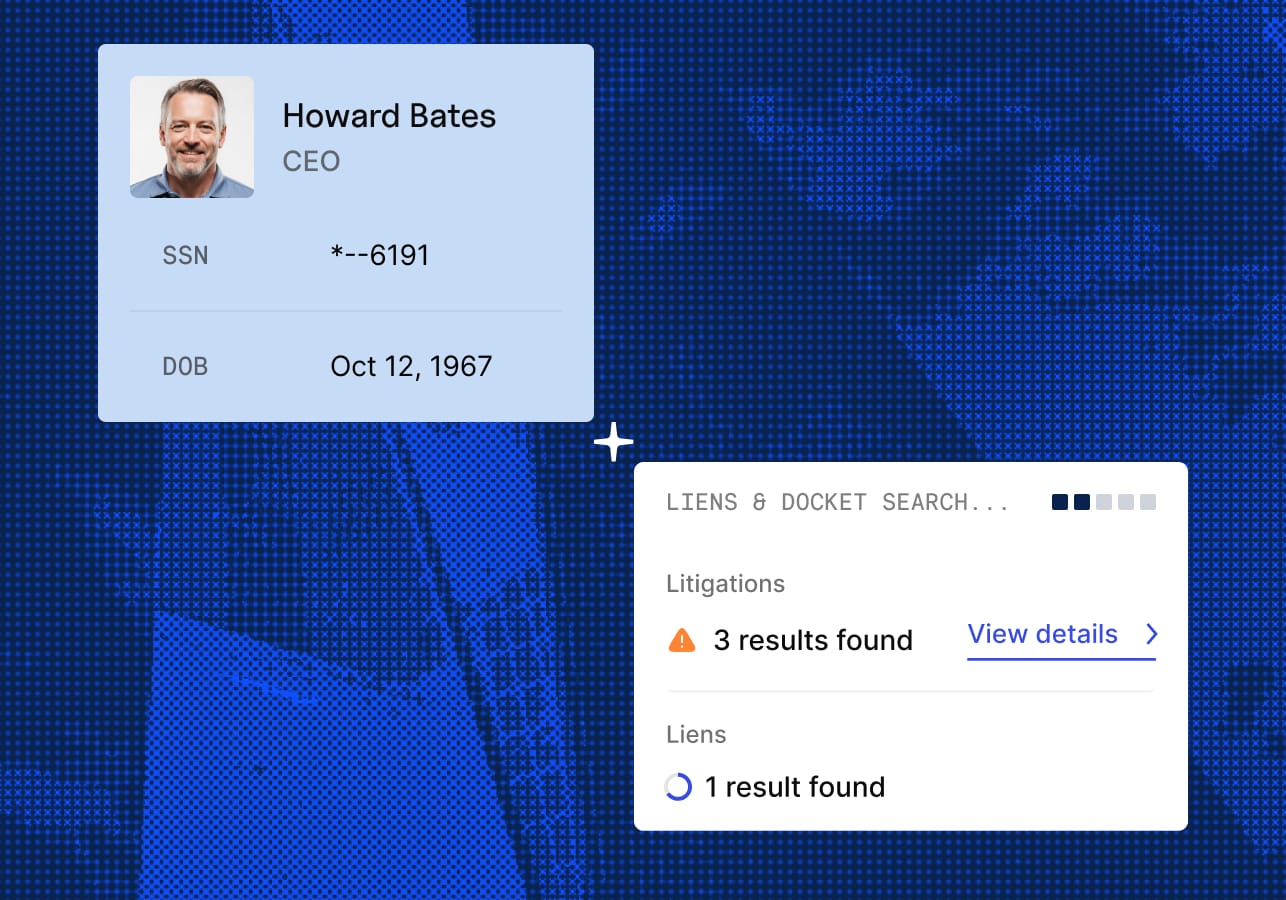

Surface lawsuits and liens in seconds

Baselayer’s Risk Co.Pilot flags individuals with outstanding liens, bankruptcies, or litigation history, helping you spot potential risk before onboarding.

"Baselayer lets us focus on the customers we actually want to serve, without simply increasing the requirements on everyone"

Spot signs of prior financial crime

AI-driven analysis validates and contextualizes external fraud and criminal-history signals, reducing false positives linked to business owners and authorized signers.

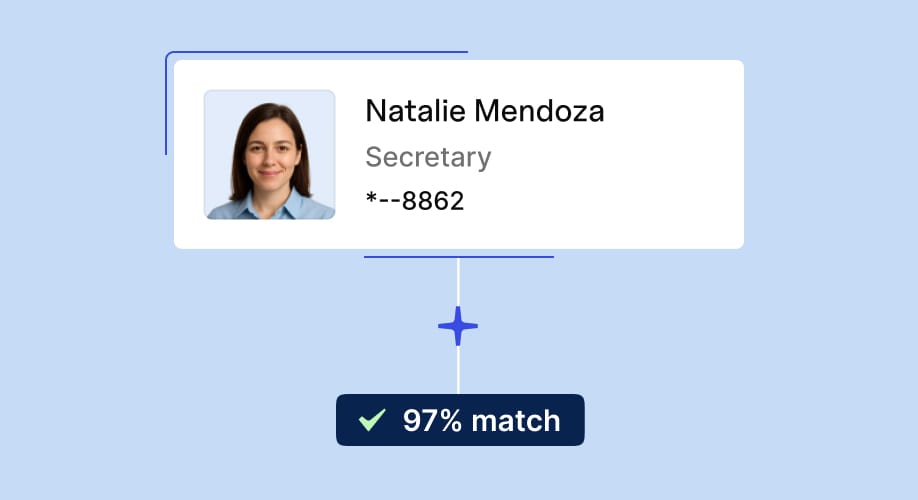

Stop synthetic identity fraud before it starts

Instantly verify against the SSA’s DMF to flag deceased individuals and prevent downstream identity-based fraud.

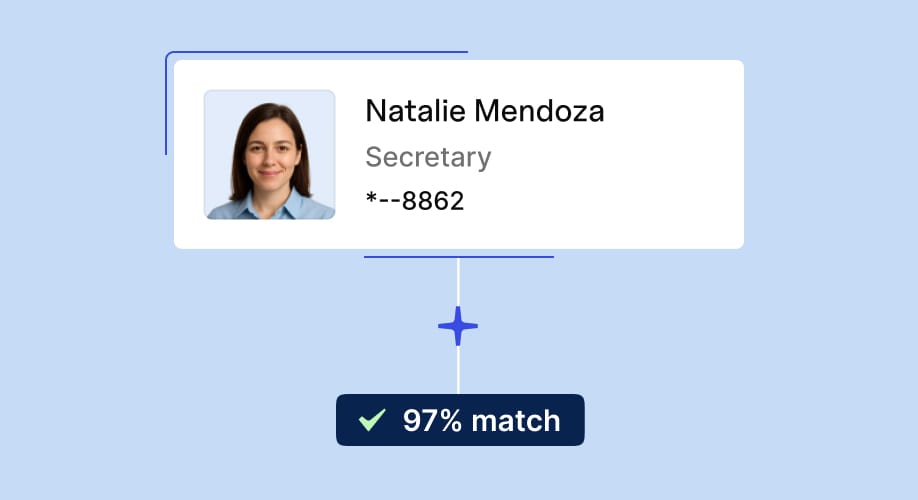

Smarter matching, fewer manual reviews

Reduce false positives by leveraging Baselayer’s extensive database and intelligent matching logic.

Reduce false positives by leveraging Baselayer’s extensive database and intelligent matching logic.

Turn signals into AI-powered decisions

Product Managers

Credit & Underwriting Teams

Risk & Fraud Teams

Compliance Teams

A Risk Co.Pilot engineered to deliver fast, reliable decisions at scale

Accelerate your workflows through the most advanced enterprise-grade API and web application for uncovering KYB, credit, and fraud signals.

Automate identity and business checks end to end with agentic AI

Business Verification

Get instant identity clarity.

Industry Prediction

Know the business behind the name.

KYB Rating

Summarize risk in seconds.

Social Media & Reviews

Go deeper into businesses.

Have questions? Find answers.

Baselayer Consumer Solutions gives you instant screening of officers, owners, and authorized signers. You can check for sanctions, military status, lawsuits, criminal background, bankruptcies, liens, and fraud signals, helping you uncover hidden risks that standard KYB checks miss.

Bad actors often hide behind real businesses. Baselayer connects people to entities, helping you catch sanctioned individuals, fraudsters, or synthetic identities that business-only checks miss. If the people aren’t legitimate, the business probably isn’t either.

You can screen for MLA, SCRA, sanctions (OFAC, PEP), criminal history, bankruptcies, lawsuits, liens, and deceased identities. All automated, all delivered in seconds.

You can automatically meet regulatory requirements for MLA, SCRA, and sanctions screening with auditable results and real-time verification against government sources like DMDC, OFAC, and SSA DMF.

Checks are fully automated and typically return results in seconds. You can access them through your dashboard or integrate them via API directly into your onboarding or credit workflows without any delays.