Risk Co.Pilot

Unlock Superintelligence

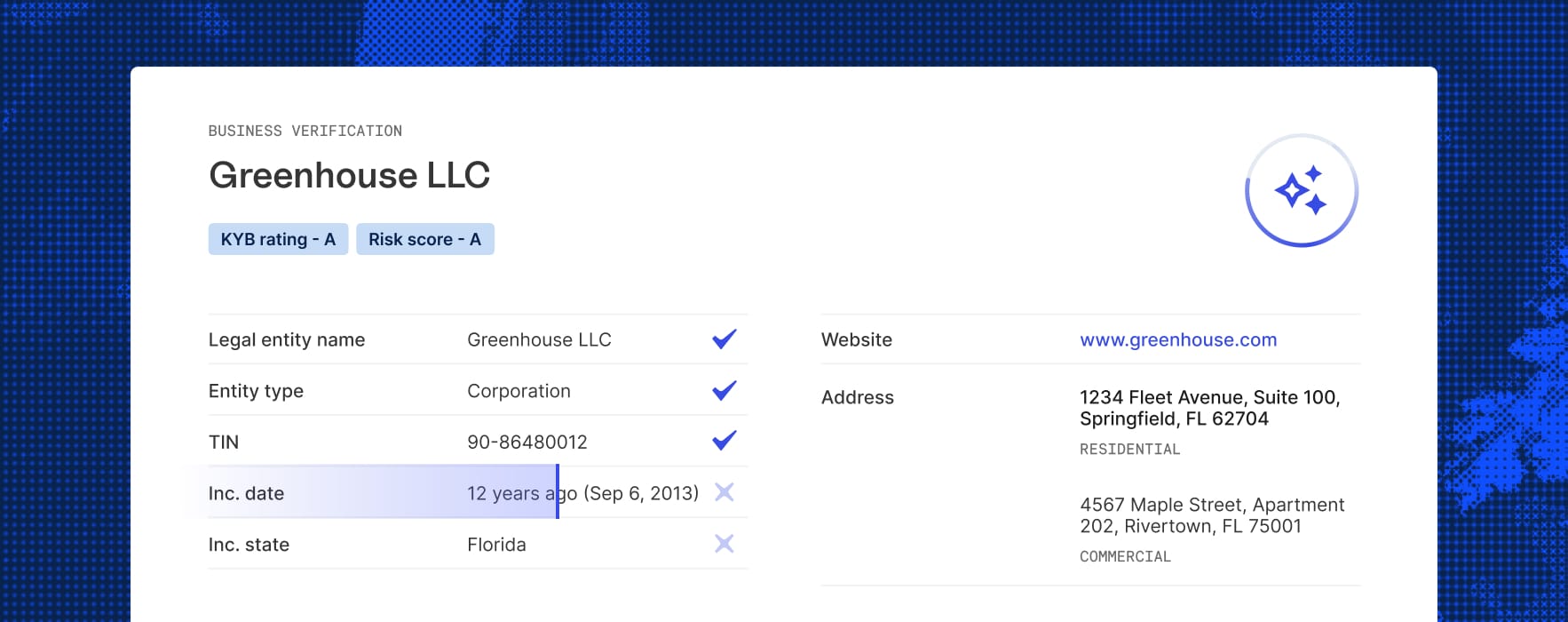

Baselayer’s Risk Co.Pilot puts labor-intensive risk checks on autopilot, delivering instant, explainable decisions that reduce cost and minimize human error.

Baselayer’s Risk Co.Pilot puts labor-intensive risk checks on autopilot, delivering instant, explainable decisions that reduce cost and minimize human error.

Trusted by developers and industry leaders at 2,200+ financial institutions

Uniform decisions. Unlimited coverage.

Risk Co.Pilot makes every check consistent, explainable, and immediate. Trained on millions of identity, credit, and fraud signals, it surfaces anomalies instantly and keeps your team focused on what matters.

Automation you can trust

Trusted consistency, every time

Run every check the same way, every time, removing subjectivity, drift, and inconsistency across teams and workflows.

Reduce manual work

Surface relevant external signals in seconds, freeing teams to focus on clients instead of repetitive research.

Spot anomalies in real time

Continuously detect identity mismatches, risky behavior, and outliers the moment they emerge, with scalable automation that removes manual review overhead.

Scale risk reviews with confidence

Handle growing volume and complexity with consistent, explainable decisions without adding headcount or increasing risk exposure.

It’s [Baselayer] become a core part of how we de-risk our lending process.

Sarvesh BavejaRisk & Data Science @ Fundbox

Baselayer allows our team to progress faster and without the burden of potentially duplicating mistakes.

Ian BradleyHead of Ops & Technology @ Breakout Finance

Automate repeatable checks with 72% less manual review

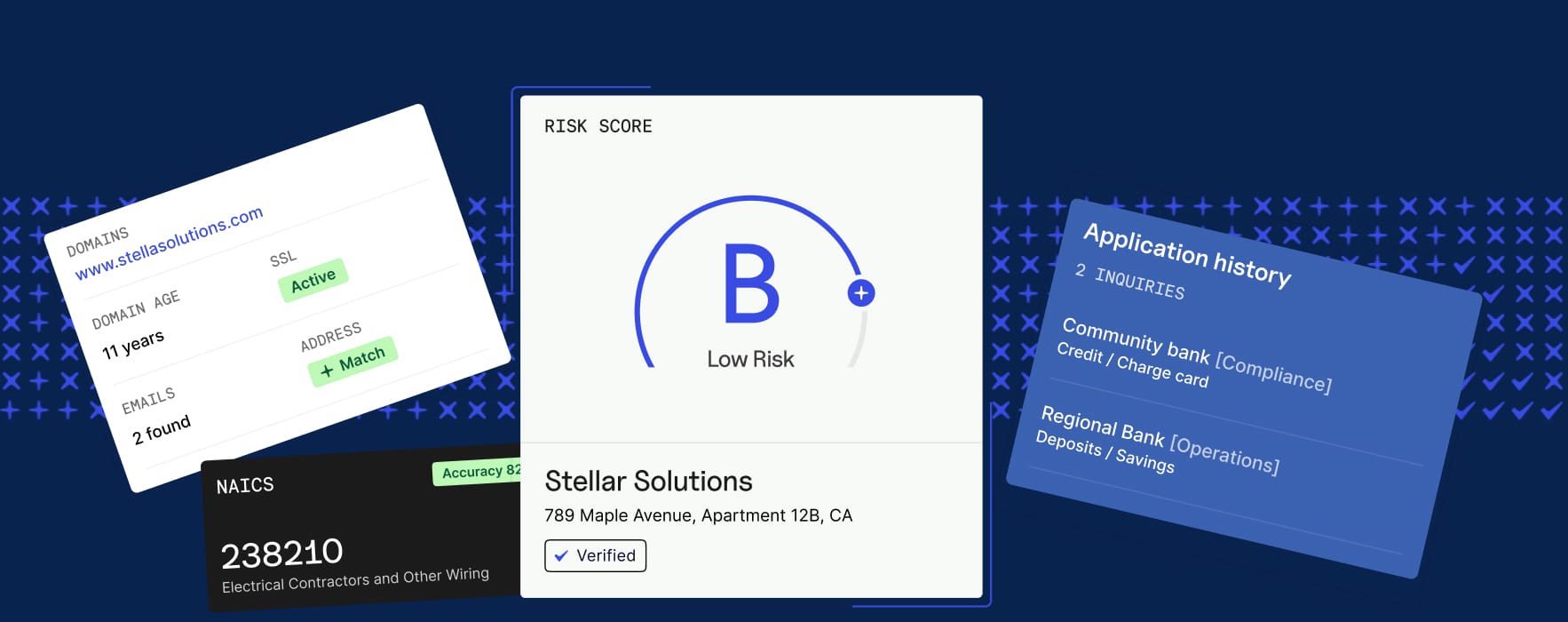

Cross-check key identity attributes in seconds.

Run every check the same way, every time. Removing subjectivity, drift, and inconsistency across teams and workflows.

Assign real-time risk scores with intelligent insight.

Agents evaluate operational, legal, and behavioral signals to generate actionable SMB scores.

Detect portfolio shifts before they become problems.

Agents track entity-level activity like liens, lawsuits, or sudden application surges and trigger alerts immediately.

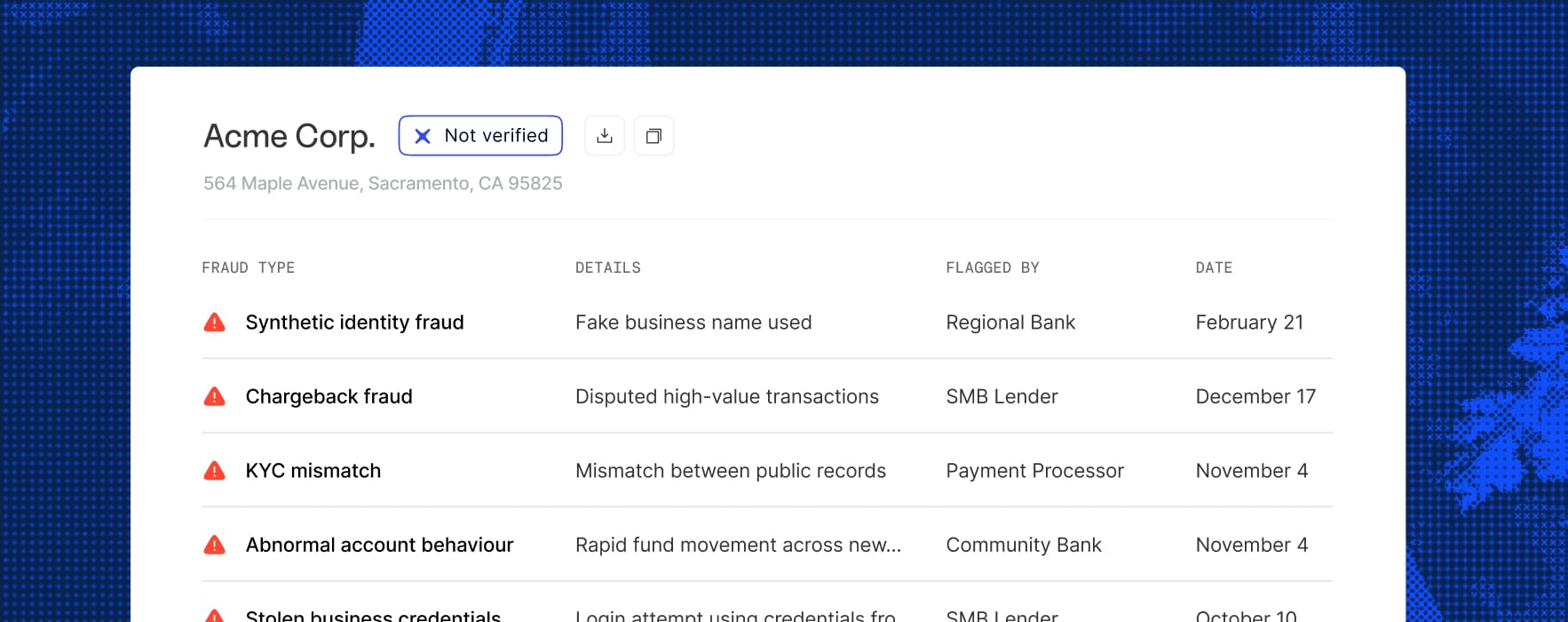

Uncover coordinated risk, not just red flags.

AI Agents connect identity variations, suspicious timing, and application patterns across the network to surface organized fraud.

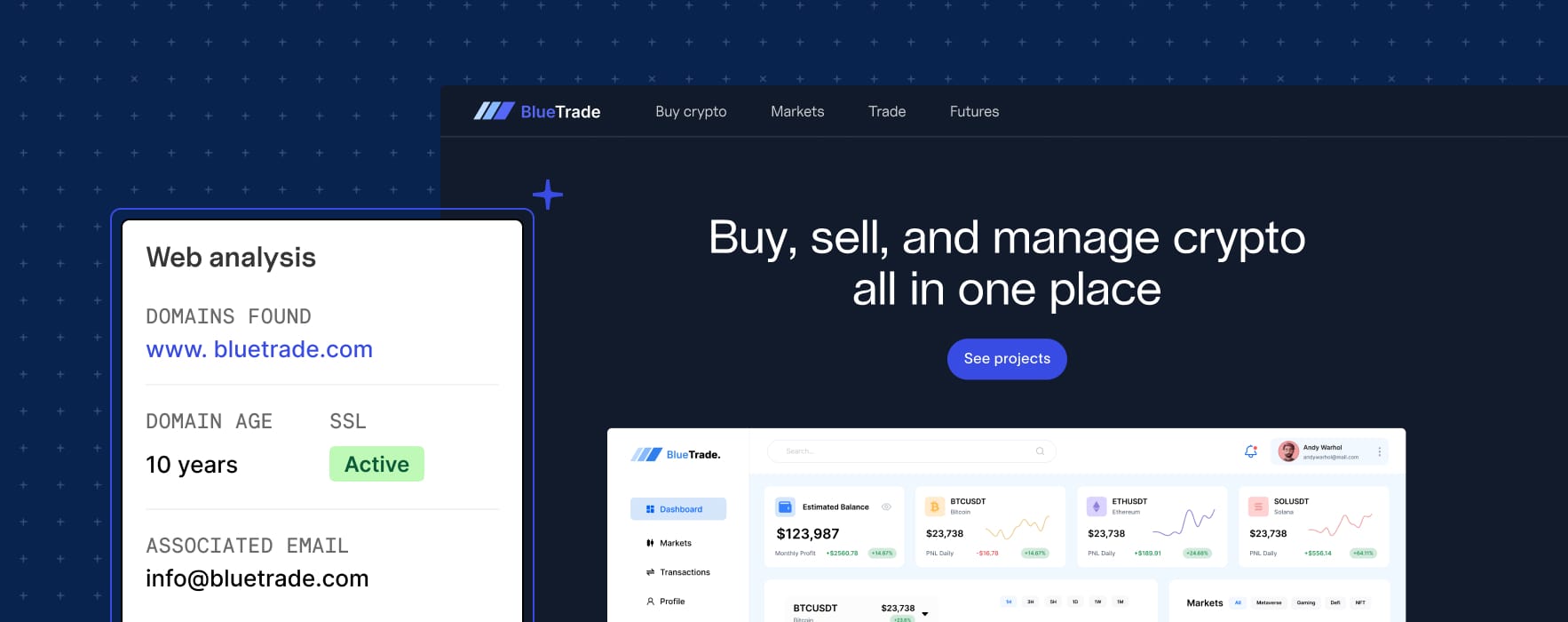

Analyze digital presence with no manual review.

Find, scrape, and assess websites to detect spoofed domains, inactive pages, and metadata anomalies. No manual review required.

Risk Co.Pilot is engineered to deliver fast, reliable decisions at scale

Accelerate your workflows through the most advanced enterprise-grade API and web application for uncovering KYB, credit, and fraud signals.

Reveal hidden identity risks.

Tap into an AI-powered network to detect emerging fraud trends before they spread.

Baselayer Identity NetworkConsolidate every data source.

Combine public, proprietary and partner data sources together into Baselayer's superintelligent platform for predictive real-time insights.

Our Data sourcesStop fraud before it spreads.

Leverage AI and verified fraud intelligence from top financial institutions to make your first line of fraud defense your strongest.

Fraud Consortium

Have questions? Find answers.

The Baselayer Identity Network is a real-time network that tracks how business identities are used across financial institutions. By linking business application activity across platforms, you get a behavioral layer for business identity that helps you detect stacking, velocity, and synthetic risk that traditional KYB can’t see.

KYB and credit checks validate who a business is, but Baselayer adds context around how that identity is behaving, including application frequency, across which institutions, and whether the pattern suggests risk. You get visibility into gaps that standard verification tools leave wide open.

By monitoring cross-platform application activity, the Baselayer Identity Network detects behavior patterns like stacking, bust-outs, and synthetic blends before credit data changes or fraud losses hit. You can spot coordinated fraud attempts while they’re still in the application stage.

Participation is anonymized and built around business signals without sharing PII. You contribute activity data in a privacy-preserving format and gain access to real-time intelligence from across the network without compromising customer privacy.

No, this isn’t about repayment history. Baselayer shows you how a business is being used right now across the financial ecosystem. It flags risky behaviors like application stacking or velocity spikes that traditional credit scores miss.

For credit score alternatives designed for SMBs see Baselayer Risk Rating.